Economic Update Q3 - 2024

11 December 2024

11 December 2024

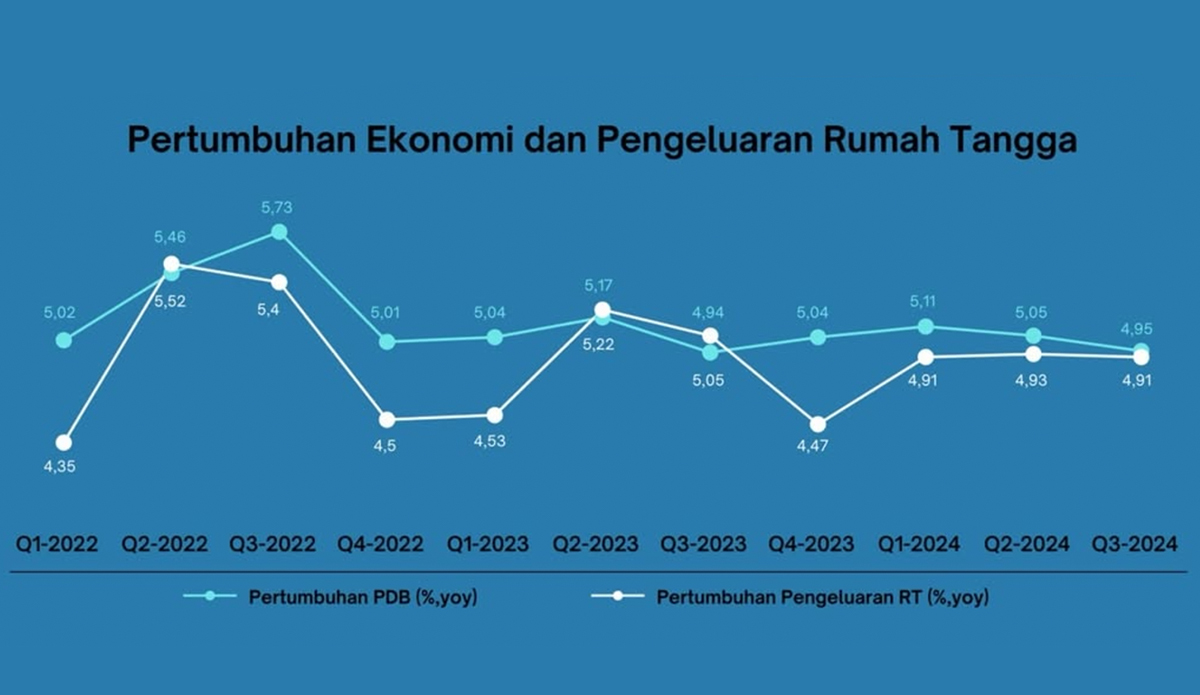

In the third quarter of 2024, Indonesia's economy recorded its first growth below 5% since Q4-2021, at 4.95% on an annualized basis (yoy) and 1.50% on a quarterly basis (qtq). These figures are lower than Q2-2024, where growth reached 5.05% (yoy) and 3.79% (qtq). This slowdown was influenced by both domestic and global factors.

In the context of domestic conditions, the decline in purchasing power, especially of the lower middle class, needs to be particularly watched out for. This decline is reflected in the reduction of the middle class as they move down to the middle class level from 23% of Indonesia's total population in 2018 to only 18.8% in 2023. On the other hand, the middle class rose from 49.6% to 53.4% in the same period. Signs of slowing household consumption in this quarter continued to be evident, reflected in this quarter's growth (4.91%) which was lower than the previous quarter (4.93% yoy) and the same quarter last year (5.05%).

Source: Badan Pusat Statistik (November 2024)

This decline in public consumption will continue to slow down the pace of growth, given its role as the biggest pillar of the national economy, contributing 53% to GDP. Consumption only grew by 4.91% (yoy). The increase was driven by consumption for restaurants and hotels. Consumption of transportation and communication also increased. This indicates an increase in leisure needs among the public.

In terms of sectors, the manufacturing industry is still the largest contributor to GDP, contributing 19% and growing 4.7% (yoy). This growth was driven by strong domestic demand, particularly in the food and beverage sector (grew 5.8%) and the base metal industry (grew 12.4%). At the regional level, Maluku and Papua recorded the highest growth, driven by policies to downstream natural resources.

On the global front, uncertain global conditions persisted and impacted Indonesia. Geopolitical tensions in several regions and China's economic slowdown negatively impacted Indonesia's export demand. Reflected in the prices of national leading commodities such as iron ore, coal, and nickel, which decreased by 13.3%, 7.3%, and 20.4% (yoy), resulting in depressed trade performance, reflected in the negative net export contribution of -0.08% to GDP.

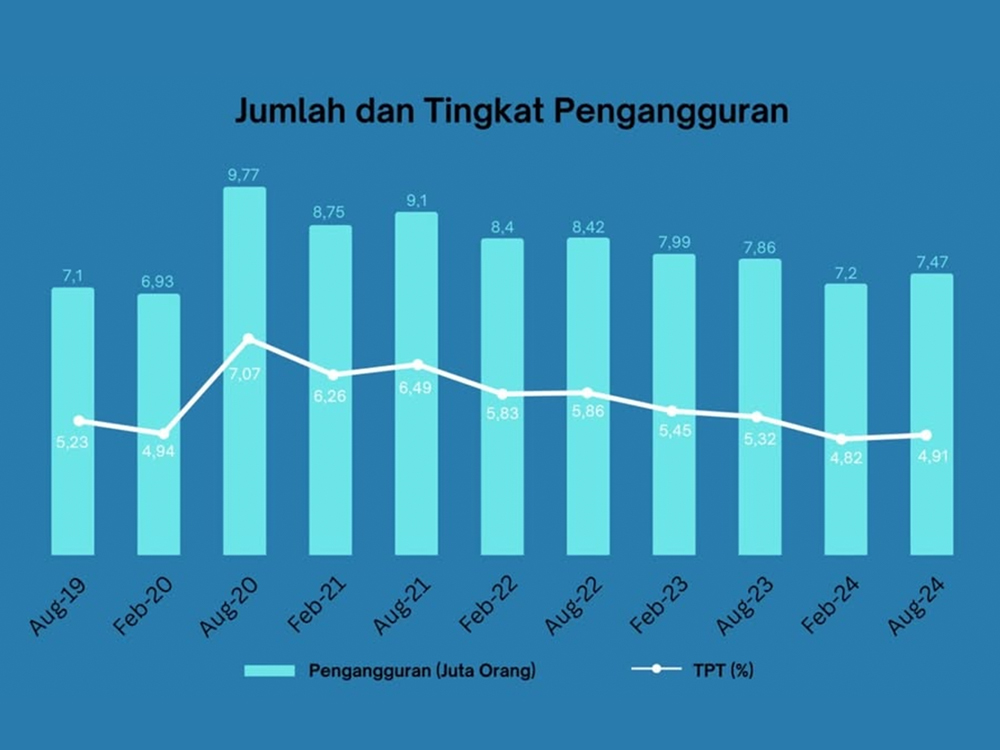

In the labor market, the open unemployment rate in August 2024 stood at 4.9%, lower than August 2023's 5.3%, reflecting an improving labor market. However, this figure was slightly higher than February 2024 (4.8%) due to an increase in layoffs in the manufacturing sector, particularly textiles. While open unemployment declined, the proportion of fully employed people also fell from 68.92% in August 2023 to 68.06% in August 2024, while the underemployment rate increased from 6.68% to 8%. These conditions lowered household disposable income, which can explain the slowing trend in household consumption in this quarter.

Source: Badan Pusat Statistik (November 2024)

The slowdown in economic growth can also be explained by the declining proportion of formal workers in the middle class, which is the majority of Indonesia's population. Since the onset of Covid-19, there has been a shift from formal to informal workers. In 2019, formal workers accounted for 61.71% of the total workforce in the middle class, while the proportion of informal workers was 38.29%. However, the condition of middle-class employment has worsened since Covid-19, which is indicated by the increase in the proportion of informal workers to 40.64% in 2024.In addition, there has been a shifting of business fields where middle-class workers in the industrial sector have decreased, while agriculture has increased.This indicates that there has been a decline in the quality of employment of the Indonesian middle class where the agricultural sector acts as a crisis cushion.

Source: Badan Pusat Statistik (August 2024)